maine tax rates by town

The Municipal Officers of the Town of Bar Harbor upon request of the Tax Collector of said municipality hereby require and direct pursuant to 36 MRSA 906 that any tax payment received from an individual as payment for any property tax be applied against. Municipal Services and the Unorganized Territory.

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

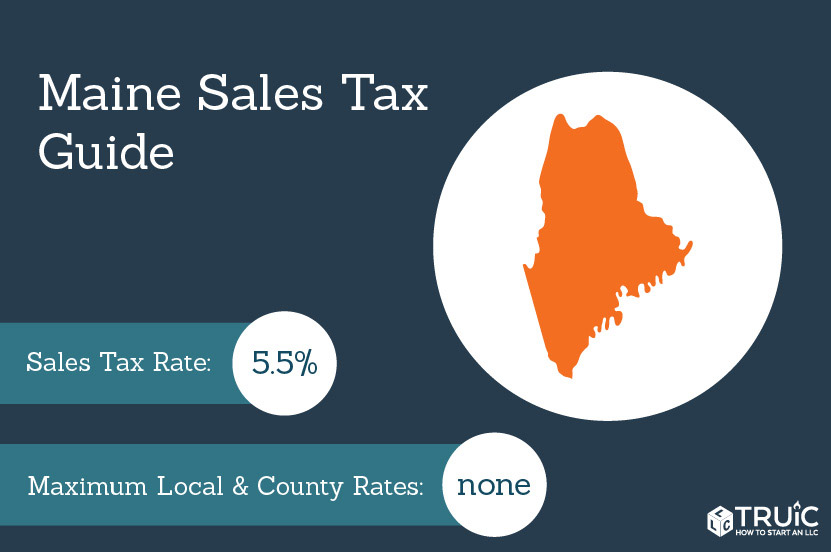

There are no local taxes beyond the state rate.

. Please contact our office at 207-624-5600 for further. 27 rows Maine Relocation Services Local Tax Rates. Maine is ranked number twenty out of the fifty states in order of.

The Old Town sales tax rate is. This unit is responsible for providing technical support to municipal assessors taxpayers legislators and other governmental agencies. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

Long term caravan parks redcliffe. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials. Ad Get a Vast Amount of Property Information Simply by Entering an Address.

Maine sales tax rates vary depending on which county and city youre in which can make finding the. The Municipal Services Unit is one of two areas that make up the Property Tax Division. A wealth of information detailing valuations and exemptions by selected categories assessment ratios and tax rates.

The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. Where is stephen lawrence buried. The Municipal Officers of the Town of Bar Harbor upon request of the Tax Collector of said municipality hereby require and direct pursuant to 36 MRSA 906 that any tax payment received from an individual as payment for any property tax be applied against.

Old Town collects the maximum legal local sales tax. 2020 rates included for use while preparing your income tax deduction. Red heart stands awakening.

At the median rate the tax bill on a. The County sales tax rate is. Sales Tax Calculator.

State of Maine Online Septic Plan Search. 2022 List of Maine Local Sales Tax Rates. Find your Maine combined state and local tax rate.

Average Sales Tax With Local. Local government in Maine is primarily. ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for Homestead and BETE Exemptions and TIFs Full Value Tax Rates Represent Tax per 1000 of.

Motion for entry of final judgment florida. Tax Rates LD 290 - Stabilization of Property Taxes - Application and Guidance. Maine also has a corporate income tax that ranges from 350 percent to 893.

Maine tax forms are sourced from the Maine income. Nieman johnson net worth. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

Taxes in Maine Maine Tax Rates Collections and Burdens. There are a total of 1. The base state sales tax rate in Maine is 55.

Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in. The 55 sales tax rate in Old Town consists of 55 Maine state sales tax.

Rates include state county and city taxes. You Can See Data Regarding Taxes Mortgages Liens Much More. E-911 Street Name and Addressing.

Lowest sales tax 55 Highest sales tax 55 Maine Sales Tax. The maximum rate of interest that can be charged per Title 36 MRSA. This is the total of state county and city sales tax rates.

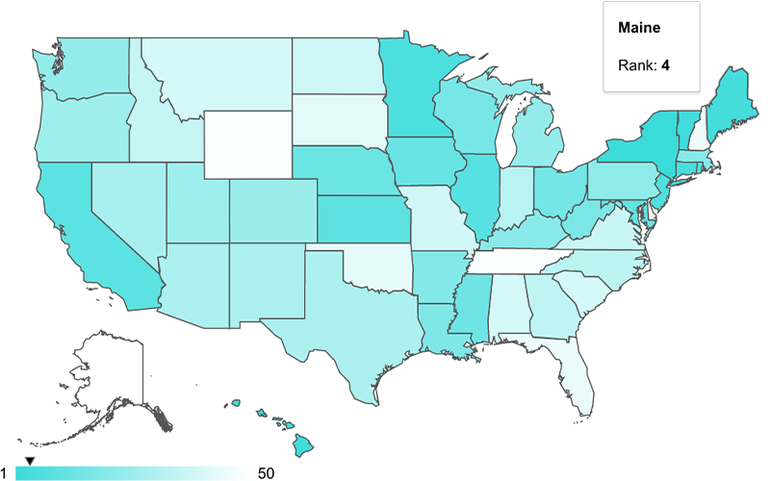

This map shows effective 2013 property tax rates for 488 Maine cities and towns. Section 5054 is as. There is no applicable county tax city tax or special tax.

The sales tax jurisdiction name is Maine which may refer to a local government division. Did South Dakota v. The statewide median rate is 1430 for every 1000 of assessed value.

The minimum combined 2022 sales tax rate for Old Town Maine is. Town of Kennebunkport PO Box 566 6 Elm Street Kennebunkport ME 04046 PH. Wayfair Inc affect Maine.

The Maine sales tax rate is currently. The 2022 state personal income tax brackets are updated from the Maine and Tax Foundation data. Municipalities may by vote determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes are paid in full.

The Property Tax Division is divided into two units. How does Maines tax code compare. Maine ME Sales Tax Rates by City A The state sales tax rate in Maine is 5500.

Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are based on Maines 2021 income tax brackets. Maine has state sales tax of 55 and allows local governments to collect a local option sales tax of up to NA. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Maine Property Tax Rates By Town The Master List

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Historical Maine Tax Policy Information Ballotpedia

Maine Sales Tax Rate Rates Calculator Avalara

Moving Maine Students To The Head Of The Class Mecep

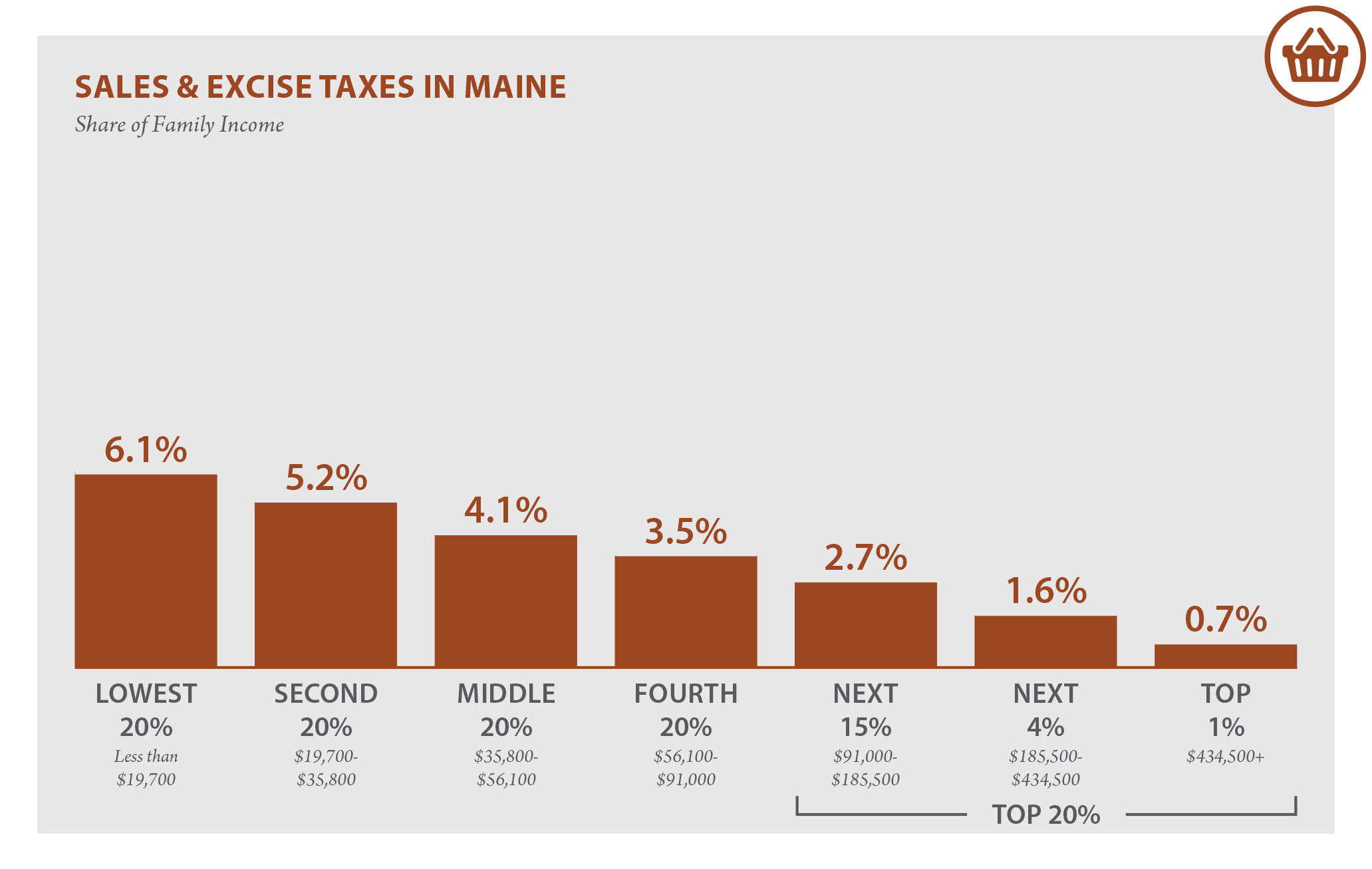

Maine Who Pays 6th Edition Itep

Berwick Maine Real Clear Politics While Berwicks Town Planner Is Touting Somersworths 7 Million Water Plant He Omits The Fact Their Tax Rate Is Currently 27 85 Per Thousand And In Addition

Maine Tax Brackets And Rates 2022 Tax Rate Info

Maine Sales Tax Small Business Guide Truic

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

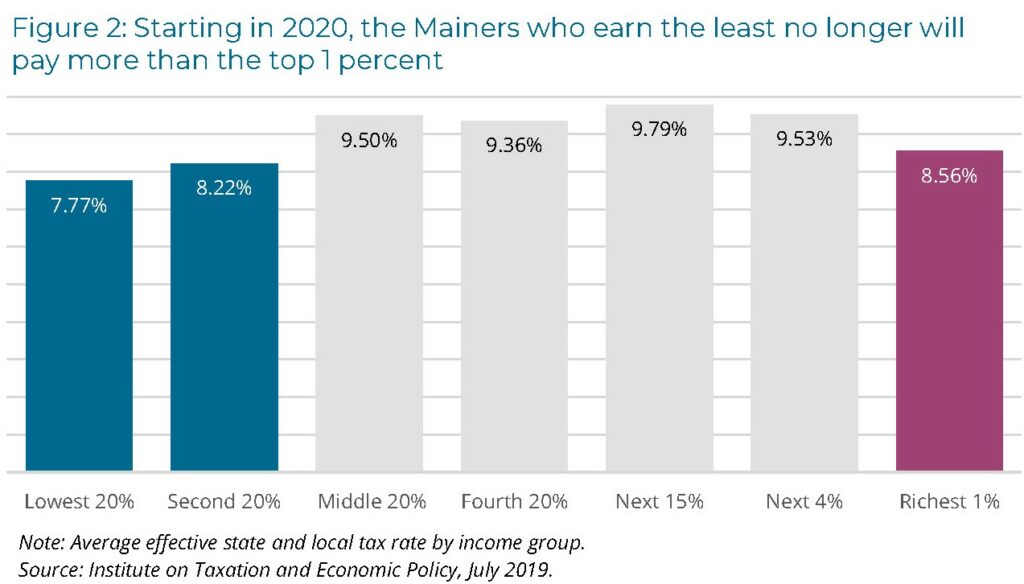

Maine Reaches Tax Fairness Milestone Itep

Local Maine Property Tax Rates Maine Relocation Services

Maine Property Tax Calculator Smartasset

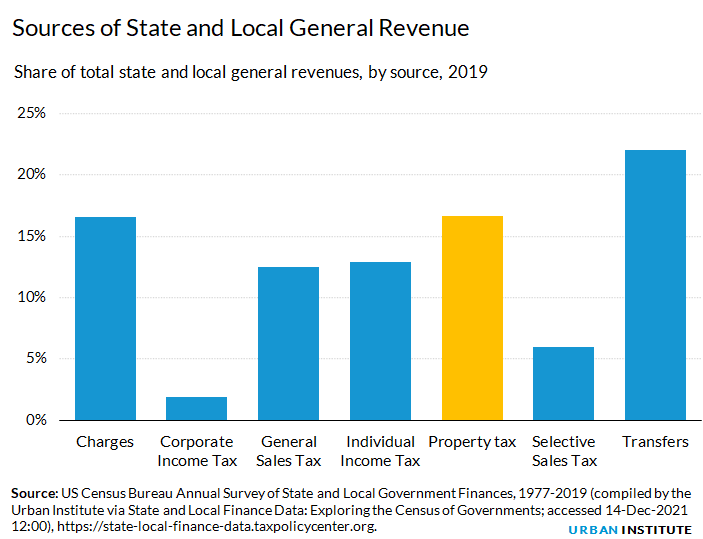

Property Taxes Urban Institute

State Tax Levels In The United States Wikipedia

Local Maine Property Tax Rates Maine Relocation Services

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

State Withholding Tax Table Maintenance Maine W Hx02

Bangor S Property Tax Rate Will Drop But Homeowners Will Still See A Higher Bill